Manufacturer Warranty vs. Bettersafe: What’s the Difference?

When purchasing a new vehicle or gadget, it's common to receive a manufacturer warranty. However, understanding the scope and limitations of these warranties is crucial. Bettersafe offers a range of insurance products that can complement or even surpass the protection provided by manufacturer warranties. This article delves into the distinctions between manufacturer warranties and Bettersafe's offerings, helping you make informed decisions about safeguarding your investments.

Understanding Manufacturer Warranties

A manufacturer warranty is a promise from the manufacturer to repair or replace a product if necessary within a specified period. These warranties typically cover defects in materials or workmanship but often exclude damages resulting from accidents, misuse, or normal wear and tear.

Key Features of Manufacturer Warranties:

Duration: Usually limited to a specific time frame, such as 3 years or 36,000 miles for vehicles.

Coverage Scope: Primarily covers manufacturing defects; may not include accidental damage or theft.

Limitations: Often excludes routine maintenance, wear-and-tear items, and damages from external factors.

Bettersafe Insurance Products: An Overview

Bettersafe.com provides a suite of insurance products designed to offer comprehensive protection beyond what manufacturer warranties typically cover. Their offerings include:

Car Hire Excess Insurance: Covers the excess fee that car hire companies may charge if your rental car is damaged or stolen.

Private Car Excess Insurance: Protects against the excess amount you would need to pay in the event of a claim on your private car insurance.

Home Excess Insurance: Covers the excess on your home insurance policy, ensuring you're not out of pocket when making a claim.

Travel Insurance: Provides coverage for medical emergencies, trip cancellations, and more during your travels.

Commercial Vehicle Excess Insurance: Designed for businesses, covering the excess on commercial vehicle insurance policies.

Income Protection: Offers financial support if you're unable to work due to illness or injury.

GAP Insurance: Covers the difference between your vehicle's purchase price and its current market value if it's written off.

Roadside Assistance: Provides help if your vehicle breaks down, ensuring you're not stranded.

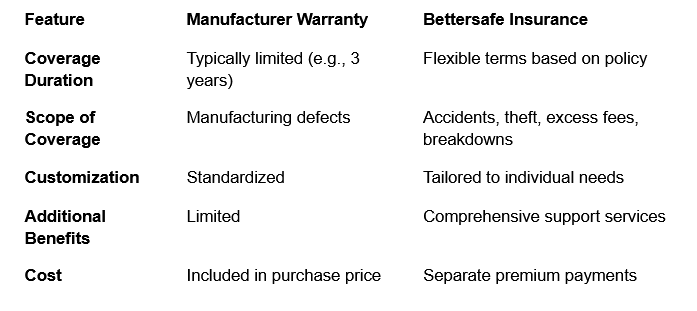

Comparing Manufacturer Warranties and Bettersafe Insurance

Advantages of Bettersafe Insurance

Comprehensive Protection: Bettersafe's policies cover a wide range of scenarios, including those typically excluded from manufacturer warranties.

Flexibility: With various products available, you can choose the coverage that best suits your needs.

Peace of Mind: Knowing that you're protected against unforeseen expenses provides confidence and security.

Expert Support: Bettersafe offers dedicated customer service to assist with claims and inquiries.