Everything You Need To Know About GAP Insurance

Guaranteed Asset Protection (GAP) is often overlooked as an insurance policy. However, if your car is written-off or stolen, a GAP policy could mean you won’t be financially damaged.

When you purchase a car, it is important to know that it will very likely depreciate. Often much faster than you would expect. In fact, a survey taken by ‘Insurance Business UK’ found that this can be as much as ‘60% within the first three years of purchase’.

Whilst most of us accept this, a 2018 study found that 34% of those surveyed expected their motor insurance policy to replace the vehicle or pay out a settlement equivalent to what they had originally paid for their car.

On top of this, 78% of people who used a finance option to purchase their car, believed that if their car was written off their motor insurance policy would pay for any outstanding balance they had.

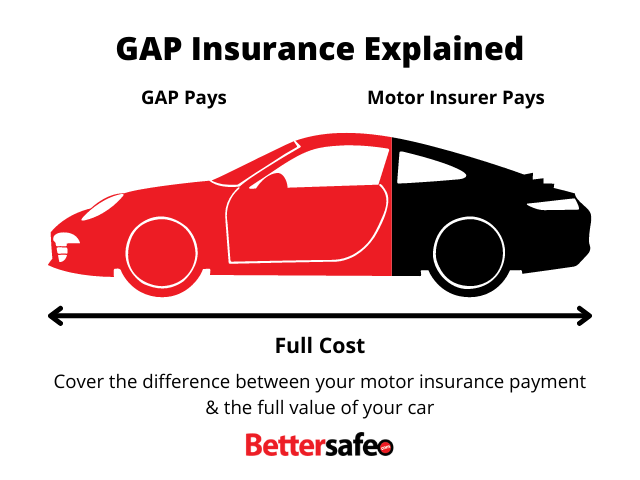

This is not the case with traditional car insurance. If your car is written off your insurer will most likely only reimburse you the amount that the car was worth at the time it was written off - not the amount you paid for the car!

Given how quickly cars depreciate, it is not surprising that drivers feel betrayed by their car insurance policy. Yet it seems apparent that few drivers in the UK are aware that there is a solution - GAP Insurance.

What Is GAP Insurance?

GAP Insurance (Guaranteed Asset Protection) is a supplementary policy that provides drivers in the UK with financial protection in the event their car is written off in an accident, stolen or irretrievably damaged by fire or flood.

Essentially, GAP insurance prevents policyholders from losing money in the event your car is written off. As the name implies, GAP insurance gives you guaranteed asset protection against loss.

Subsequently, GAP insurance policies literally bridge the financial gap between the amount your insurer is willing to pay for the market value of your car at the time it is written off, and the amount you originally paid for the car or what you still owe the finance company on the loan you took out to purchase the car.

Because cars lose value quicker than the amount you pay off the amount you borrowed, drivers are generally left out of pocket when their car is written off.

With GAP insurance, you break even. Without GAP insurance, you are still paying monthly increments for an asset you no longer have at your disposal.

Let’s look at an example.

How Does GAP Insurance Work?

You buy a brand-new Volkswagen Golf for £24,000 and take out a finance loan to pay for it. The loan has a 2.4% interest meaning you must pay a total of £28,608 for your car. As soon as you drive away in your new car it’s worth £21,600. Each month you pay £280 on your loan. After owning the car for two years you have an unfortunate accident, and the car is written off.

You have paid a total of £6,720 off your £28,608. After two years, your car is valued at £19,200. However, you still owe the finance company £21,888. Without GAP insurance, you are £2,688 out of pocket - and you don’t have a car. With GAP insurance, your policy would cover you for the total cost of the price you paid for the car - in our example, £24,000.

When you lease a car from a hire firm, insurance companies insist that you are covered by comprehensive coverage or collision coverage. Either of these policies enables you to claim compensation to help you repay the lease contract for the full term.

However, under the terms of comprehensive coverage or collision insurance, the amount you are paid for a written off or stolen lease car is determined by the depreciated value of the car.

So, what happens if the amount you owe on your lease hire contract is more than the depreciated value of your car?

What Defines A Vehicle As A Write-Off?

In insurance, there are three ways a vehicle can class as “written off”.

- The vehicle is now only fit for scrap and should never be driven again.

- The vehicle is unfit for the road, should never be driven again, but some parts of it can be salvaged

- A financial write-off, the vehicle could be repaired, but the costs of repairing the vehicle are too high and it exceeds the initial price of the vehicle.

It’s quite remarkable that only one in ten people take out GAP insurance cover when they buy a new car. Especially when you consider that, on average, 384,000 vehicles are written off every year in the UK. That means around 380,000 people do not recover the full value of their car. Some car owners will lose thousands of pounds.

For more information, see our article on how much you can lose if your car is written off.

How Do Cars Lose Value?

It is a well-established fact that cars depreciate as soon as you drive them off the forecourt. According to the AA, the average deprecation of a car is deemed to be around 20% a year.

However, experts also acknowledge that the rate of depreciation largely depends on the age of the car. For example, a brand-new car may only depreciate by 10% in the first year. A second-hand car could lose as much as 40% of its value in the first year you buy it.

This means second-hand cars depreciate quicker. The same is true for expensive cars. This also means that drivers who are not covered by GAP insurance lose more money.

Certain brands tend to depreciate quicker due to a reputation for poor reliability. In the UK market, French and Italian cars generally fall into this bracket.

Whatcar publishes a new list of the fastest depreciating cars each year.

The amount a vehicle depreciates is determined by its age and the number of miles it has covered. According to the AA, a brand-new car will lose around 40% of its value within the first year and cover 10,000 miles.

If you consistently drive 10,000 miles a year, the car will lose 60% by the end of the third year.

It’s impossible to estimate how much anyone’s car will depreciate, but as a rule the average industry figure are:

- 15-35% after 12 months.

- 40-60% after 36 months

- 60-70% after 60 months

- 80% depreciation after 92 months

That means that in most instances when a leased car is written off or stolen and you don’t have GAP insurance, you can lose a significant amount of money.

Want to know which cars depreciate the quickest? Look at this article.

What Are The Requirements For A GAP Insurance Policy?

To be covered by a Bettersafe GAP policy, the following need to apply to you:

- You are the owner of the registered keeper of the vehicle.

- You have paid the insurance premium for this policy.

- The value of your vehicle does not exceed £80,000 at the date of purchase.

- Your vehicle was under 8 years old at the start date of this policy.

- Your vehicle is covered by a comprehensive motor insurance policy throughout the period of insurance.

- Your vehicle is registered in the United Kingdom.

- Your vehicle was not purchased via a private sale.

- Your vehicle is not used for rental purposes.

- Your vehicle was purchased within 60 days prior to the start date of this policy.

Remember, always make sure you read the policy wording before buying any insurance policy. You need to make sure that you are eligible for cover.

What Does GAP Insurance Not Cover?

GAP insurance is not ideal for all car owners. Policies only kick-in the insurance company declare the vehicle is a “write-off” or “total loss”. With that in mind, let’s look at what GAP insurance does not cover.

- If you have an accident and your car is repaired, a GAP insurance policy does not cover the cost of repairs; only when the car is irreparable and deemed unroadworthy.

- Vehicles valued at more than £80,000 are not eligible for GAP insurance.

- A GAP insurance policy will not pay out if the driver was drunk driving or considered by law to have been driving negligently such as reckless driving or not paying due care and attention (i.e., texting).

- If your car is stolen but you did’t take due care to protect your assets; you leave the keys in the engine whilst you open your gates at home, and someone drives away in your car.

- GAP insurance cannot be claimed if your motor insurance policy does not payout.

- When you have an accident there may be other expenses to pay such as medical bills and the costs of the hire car. GAP insurance does not cover consequential losses.

- When a car is written off, motor dealers may charge fuel and administration costs to the invoice. Invoice charges are not covered by GAP insurance, only the outstanding amount of the loan.

- Negative equity payments are not covered by GAP insurance. A typical scenario in which negative equity applies is when you trade in an old car as a part exchange for a new car, but the outstanding payments you still owe to the lender are greater than the value the car dealership is prepared to pay.

What Is Negative Equity?

Negative equity is the amount you have left to pay on a credit agreement. To give you a real-life example, let’s say you purchase an Audi A5 for £50,000 and the car dealership is prepared to pay £10,000 in part exchange.

However, you still owe £15,000 to the finance company for your old car.

To purchase the Audi, you must take out a loan of £45,000 instead of £40,000. Your comprehensive motor insurance policy values the Audi at £25,000 but you’ve only paid £12,000.

A GAP insurance policy only covers the cost of the vehicle you own - the Audi. It doesn’t pay off the remainder of the loan which is attributed to negative equity on your previous vehicle.

With negative equity left over from your old car the amount you still owe the finance company is £33,000. GAP insurance will pay £30,000 leaving you with £3000 to pay rather than £8000.

Are There Different Types Of GAP Insurance?

Broadly there are three ‘core’ types of GAP insurance.

Finance GAP Insurance

This repays the outstanding balance that you have on your financial plan after the pay-out from your motor insurance. This means you will be left debt free after your car is written off.

Return To Invoice GAP Insurance

This covers the cash difference between the price you paid for your car and the payment you received from your primary motor insurer.

Vehicle Replacement GAP Insurance

This covers the distance between the pay-out and the costs of replacing your vehicle with an equivalent one of the same model and specification. The premiums for this are usually much higher.

Bettersafe GAP Insurance

At Bettersafe we provide two types of GAP Insurance:

Combined GAP Insurance

This is a return to invoice GAP insurance (sometimes referred to as RTI GAP insurance) and pays the difference between the motor insurers settlement and the purchase price of the vehicle.

Lease GAP Insurance

This is a finance GAP insurance. This product will pay off the difference between the motor insurance settlement and the outstanding balance on your finance agreement. This will also cover your initial deposit paid on your vehicle up to a maximum value of £2000.

How Does Contract-Hire GAP Insurance Work?

GAP insurance is also available for contract hire cars - and can be particularly beneficial to businesses. GAP insurance acts as a financial buffer.

Given the executive vehicles offered as a BIK are typically expensive, a significant drop in value means contract hire cars used by companies to lose value faster than vehicles in the budget and medium price range.

Consequently, a contract hire car that is written off becomes an expensive asset. For more insights, check out our article detailing how much you can lose on a totalled car.

Contract hire GAP insurance eliminates the risk of suffering financial loss. GAP insurance pays the difference between how much the vehicle is valued at the time it is written off and the remaining balance on your lease hire contract.

The GAP insurance we offer at Bettersafe also reimburses you for up to £250 towards your motor insurance excess together with up to £2000 of the initial deposit paid when you initially entered the contract hire agreement.

For more information about how our contract hire GAP insurance can save you money, contact us today at enquiries@bettersafe.com.

Can I Get GAP Insurance On A Second-Hand Car?

GAP Insurance is fast becoming a ‘must-have’ insurance policy for all motorists. As most cars depreciate quickly over the first three years of ownership, many motorists are looking to prevent themselves from any financial shortfall if their car is written off.

On a Bettersafe Combined or Lease GAP policy your second-hand car is covered in the same way as if it were new. The main reasons you would not be covered by a policy is if the car is over 8 years old at the time of purchasing the GAP policy, or if you did not buy the car from a dealership.

GAP insurance pays out the difference between what your primary motor insurance values your car at and the price you originally paid regardless of whether you have a new car or a second-hand car.

Do I Need GAP Insurance On My Second-Hand Car?

As with any insurance policy, it depends on a person-to-person basis. However, the two factors you should take into consideration are:

- How fast and/ or likely is your car to depreciate?

- How much did you pay for the used car?

What Would Happen If You Bought The Car Outright?

If you bought your car with cash, your motor insurer would again pay out what they valued the car at when it was written off. Whilst you would be able to replace it with a car of similar value, you would still be left out of pocket.

Why Do We Think GAP Cover Is So Important?

Imagine you are driving home one day. You are in your BMW which you bought second hand two years prior for £25,000. Unfortunately, it is a rainy day and the person driving behind you puts on the brakes too late and crashes into the back of your car. Luckily, no one is hurt but your car is classed as a financial write off by your motor insurer.

Many people would expect their motor insurer to pay off the remaining debt. However, all too often, this is not the case. Unfortunately, you weren't aware of this and so you didn't purchase a GAP insurance policy.

To your frustration, the insurer only valued your BMW at £15,000. After your settlement, this has left you £10,000 out of pocket. Moreover, you only have £15,000 to buy a new car and must purchase a car with less prestige and charisma than a BMW.

How Does A Bettersafe GAP Insurance Policy Help?

A Bettersafe GAP policy would cover the difference between the motor insurer’s settlement and the amount that you have outstanding on a contract hire/ lease agreement. You would, therefore, have £25,000 to replace your BMW with a car of equal value.

Is GAP Insurance Really Worth The Investment?

GAP insurance may not present a solution to everyone. However, it is beneficial to drivers that have cars that depreciate quickly, or you have an expensive vehicle through a car hire dealership or financial credit.

For example, the value of a car can depreciate significantly over three years. Martin Lewis’s Money Saving Expert found that after three years a Citroen C- Zero (2011) retained less than 20% of its value. That is, when bought for new at £26,000, after three years it was worth just under £5,000.

In this instance, if your car were written off, you would only be paid £5,000 from your motor insurance. This would leave you £21,000 out of pocket!

Each year around 384,000 cars are written off and many people end up losing out. We have listed out a few scenarios where we believe a GAP policy would be beneficial to you.

If you have a large amount of money to pay off when your car is written off a GAP policy would likely be a good investment in this instance. If your vehicle were classed as a write-off, the policy would cover what you still owe, meaning you would be able to afford a new car to keep you on the go.

When Would A GAP Policy Not Be Worthwhile?

If you purchase a classic or rare car it is possible for a car's value to go up. In this case, we would say it is not worth buying a GAP policy as it would not benefit you if your car was written off.

Your car is less than one year old, and you have fully comprehensive car insurance. Most fully comprehensive policies offer a new car replacement during the first 12 months for new cars. If this is the case purchasing a policy may not be necessary.

If you are not bothered by the depreciation of your car and would be happy with a replacement. Your motor insurance policy will payout for a replacement for the car at the value of the car at the time it was written off. If you are not bothered by having your written off vehicle replaced with a brand-new car then GAP probably is not for you.

For any enquiries about our GAP policies or any further information, do not hesitate to get in contact with us at enquiries@bettersafe.com.